In the coming months, the Eastern Caribbean Central Bank (ECCB) will continue pushing its wealth creation agenda to get the people across the Eastern Caribbean Currency Union (ECCU) to move from being savers to investors.

“Our ambition is to see us move from four percent, which is one in twenty-five persons, to one in five persons – twenty percent over the next decade,” ECCB Governor Timothy Antoine stated.

“I have said this before: when you contrast with the United States, it’s sixty percent – three in five. Everybody in this room needs to be a financial investor,” he said.

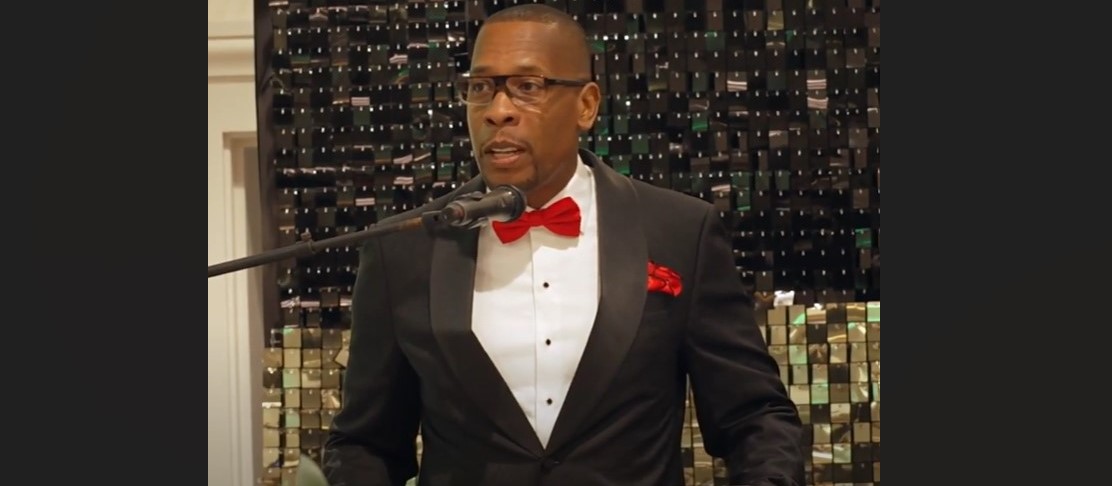

Antoine spoke at the Bank’s 2024 Staff Gala and Awards earlier this month, explaining that wealth creation helps with financial resilience.

“If there is one thing what we have to do as a region is to build resilience,” the ECCB Governor told the event, adding that resilience is the ability to withstand shocks and ‘bounce forward’.

He also spoke of the need for both personal wealth creation and inter-generational wealth transfer.

In addition, the Governor highlighted the achievements of the Eastern Caribbean Partial Credit Guarantee Corporation (ECPCGC), noting that the Corporation has issued over 130 loans valued at over $15 million.

“This is a programme that we launched during the pandemic to help small businesses access credit, it has been a little slow but it is now taking off,” Governor Antoine said.

He pointed out that small businesses across the ECCU must grow and take off to achieve the ambitious’ Big Push.’

Ultimately, the big push aims to double per capita income in the ECCU over the next decade.